Active Risk Budgeting

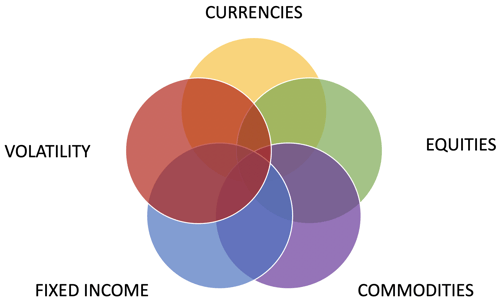

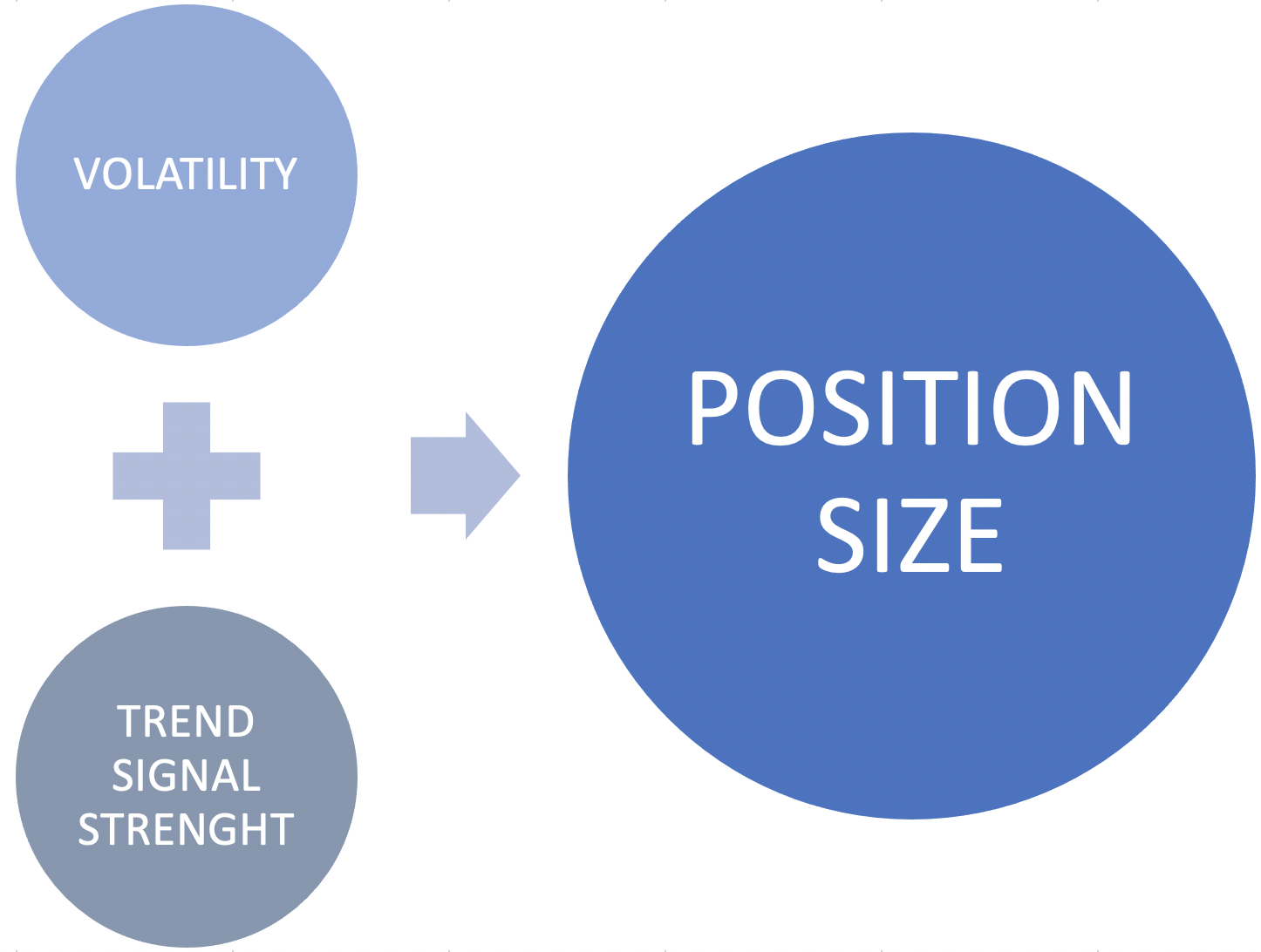

Historically, asset allocations based on balancing risk across asset classes has reduced volatility through different economic cycles when compared to traditional fixed capital allocations. Our proprietary models look at different volatility measures to judge the risk of each futures market traded. The higher the volatility of each market, the smaller the position needed to achieve the desired level of risk and vice versa. This allows the fund to control risk at the security, sector and portfolio level.

.png?width=928&height=178&name=CC-logo-horizontal-2C-1000%20(1).png)